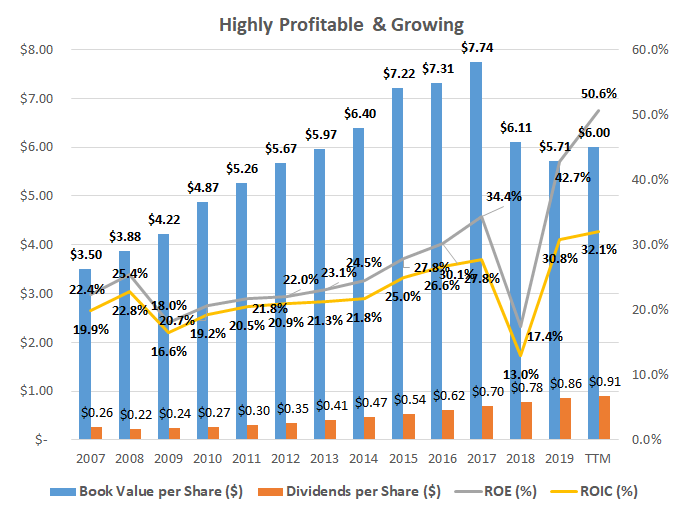

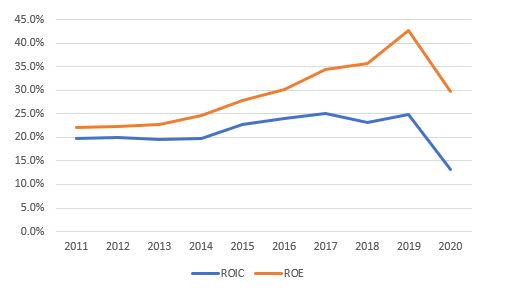

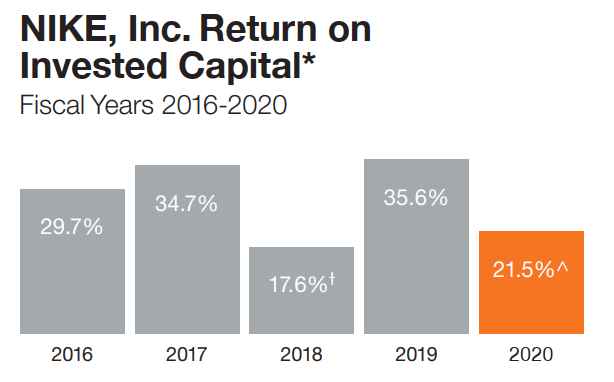

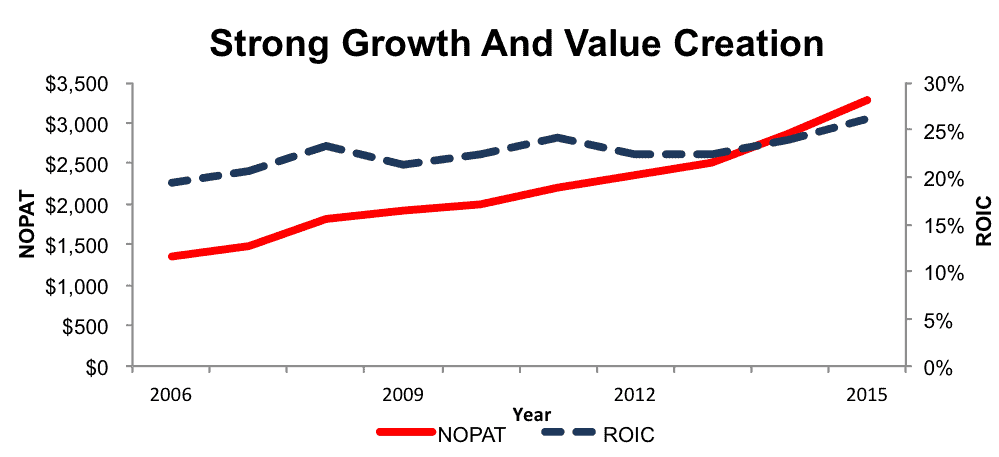

Groww on Twitter: "This means that companies can increase their ROIC in 2 ways. Either they can increase their margins or their invested capital turnover which is how much of the invested

![Amazon | [ナイキ] エア マックス 95 プレミアム AIR MAX 95 PRM ブラック/レーサーブルー/グリーンスパーク/ホワイト DA1344-014 日本国内正規品 26.0cm | NIKE(ナイキ) | ランニング Amazon | [ナイキ] エア マックス 95 プレミアム AIR MAX 95 PRM ブラック/レーサーブルー/グリーンスパーク/ホワイト DA1344-014 日本国内正規品 26.0cm | NIKE(ナイキ) | ランニング](https://m.media-amazon.com/images/I/61ROicGKhIL._AC_UY1000_.jpg)

Amazon | [ナイキ] エア マックス 95 プレミアム AIR MAX 95 PRM ブラック/レーサーブルー/グリーンスパーク/ホワイト DA1344-014 日本国内正規品 26.0cm | NIKE(ナイキ) | ランニング